Last week we saw another MASSIVE inflation print as headline CPI reached a four-decade high: 9.1%

This puts the Fed and markets in an interesting position. As inflation has yet to peak there remains pressure to raise rates even faster to slow the economy, meanwhile GDP is likely contracting for the second straight quarter. This means the Fed is in the unusual position of trying to slow the economy while GDP is contracting.

This comes as no surprise to Ri Members, as we’ve been hammering on this theme for months. We also know these conditions are setting up a trade in precious metals.

However, precious metals miners have been under significant selling pressure all year. This downward pressure is unlikely to let up before the fall, when I expect silver and gold to enter their next bull run.

Let’s dig into why.

The USD & Rates

Fact: precious metals perform well when the dollar is weakened.

Today this is largely tied to the fed funds rate. As the fed funds rate increases, overall interest rates such as treasury and credit rates rise. Higher rates typically result in a stronger economy and better returns. As global capital flows into US dollar-denominated assets, chasing higher returns, the dollar strengthens.

The important takeaway here is that the dollar won’t weaken until the Fed is forced to capitulate on their current stance by cutting interest rates.

The question is when will that happen?

The Fed will only capitulate when a recession is imminent.

Globally many central banks have been far slower than the Fed to raise rates, especially the European Central Bank (ECB) and Bank of Japan (BoJ). Because of this, we are seeing capital flee those regions and pour into US equities and bonds.

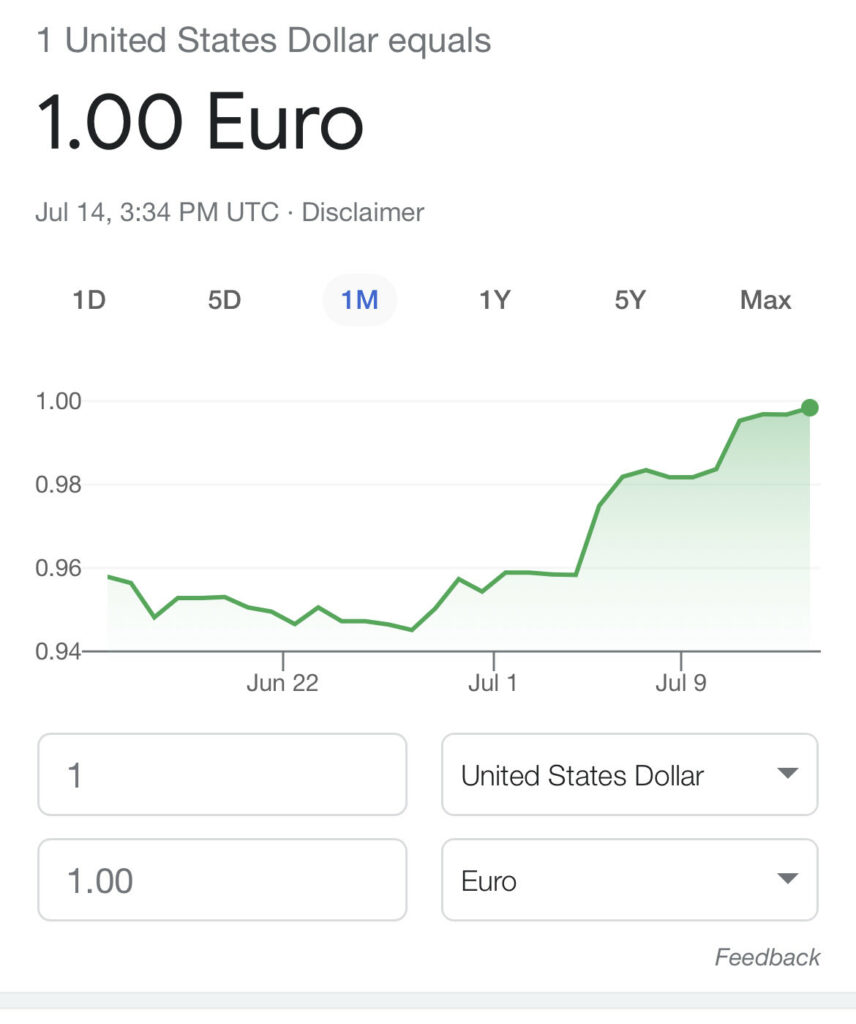

This has resulted in the USD surging higher. We’re seeing the Euro and USD hit parity for the first time.

This is good for US consumers, but bad news for exporters – AKA bad for GDP growth.

High inflation is catalyzing a narrative that the Fed is doing the right thing by raising rates to preserve US equity markets and dampen wage growth. This narrative could very likely only last a few months while the Fed maintains hope that a US recession isn’t a done deal…

BUT, the rest of the world appears to be sticking to loose monetary policy, and keeping interest rates low. The ECB and BoJ’s decision to promote loose monetary policy is furthering dollar strength, whilst their own economies struggle due to high oil/coal/natgas prices impacting growth.

REMEMBER: Energy commodities are priced in USD, meaning price increases are even greater in weak foreign countries.

For example:

- Last summer EUR€1.00 was worth USD$0.85.

- Today EUR€1.00 is worth USD$1.00.

- Last summer Brent Oil was trading at USD$70/bbl, or EUR€59.50/bbl.

- This summer Brent Oil is trading at USD$100/bbl, which is EUR€100/bbl.

While that’s a 43% increase in USD terms, it’s a 68% increase in EUR terms.

What does this mean for markets?

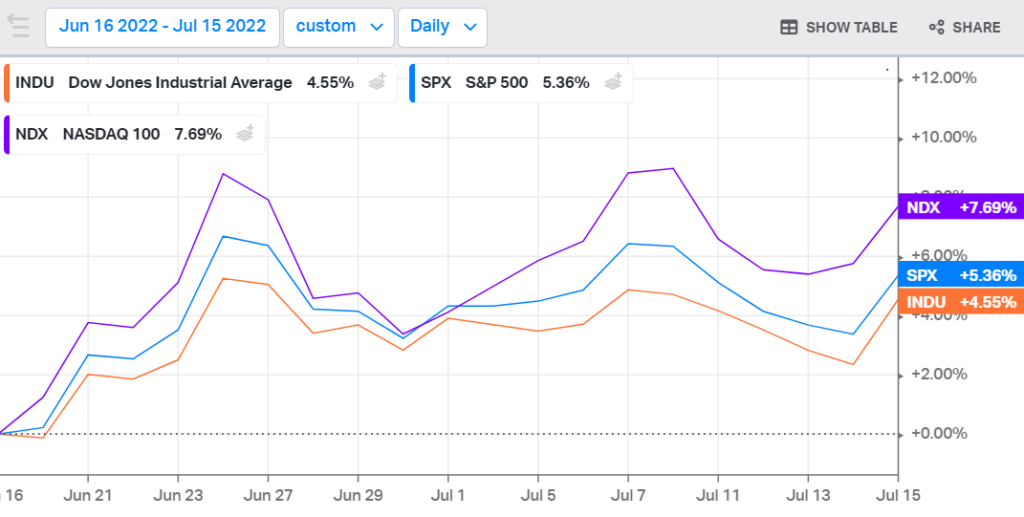

Since mid June we have seen US equity markets trading higher. Perhaps this summer we’ll continue to see a rally in US equities while USD strength persists and foreign assets plunge.

Eventually (we think this fall) stocks will finally get the message that 2023 earnings are going to SUCK. Then it’s risk off in the US this autumn and the party is over.

When the Fed realizes that the earnings outlook is bleak and a recession is imminent, only then will they start softening policy (AKA slowing hikes or cutting rates).

What will happen next (our thesis) ?

- The dollar will start to fall;

- US equity markets will sell off hard;

- Precious metals will catch a bid in a big way; and

- Energy Prices are going to soar with a weakening USD as a tailwind.

This has been a brutal few months for basically every other asset class out there. I know from talking to several Ri Members over the past month that most of you are feeling it across your portfolio.

But, buckle up friends. This ride is only getting started.

We all knew a major secular sell off was coming. We all knew tech had to get crushed. We knew the S&P was massively overvalued compared to real assets. We knew interest rates could not stay at all time lows FOREVER and had to rise.

We’ve been talking about it and positioning for months years.

Now the rebalancing is happening.

There’s a crisis, blood in the streets, and panic.

And investors are doing what they always do in a panic – going to cash. Selling anything they can at any price. Stuffing the USD under the proverbial mattress.

And when the dust settles…

When companies start getting valued on cash flow as opposed to hype…

When earnings get crushed…

When the dollar begins to slide…

And, the reality of this brave new world sets in…

Where do you think that money goes??

- Gold;

- Energy; and

- Basically every other essential commodity.

So… when you lie awake at night and think about your beaten down portfolio, fear not, you’re in the right place.

And when your friends at the country club tell you they’re buying the dip and loading up on Facebook… Maybe forward them this post and help them do a little damage control before it’s too late!

Jamie Keech

CIO; Editor

Nick D'Onofrio

Head of Research