Silent Warnings in Real Estate

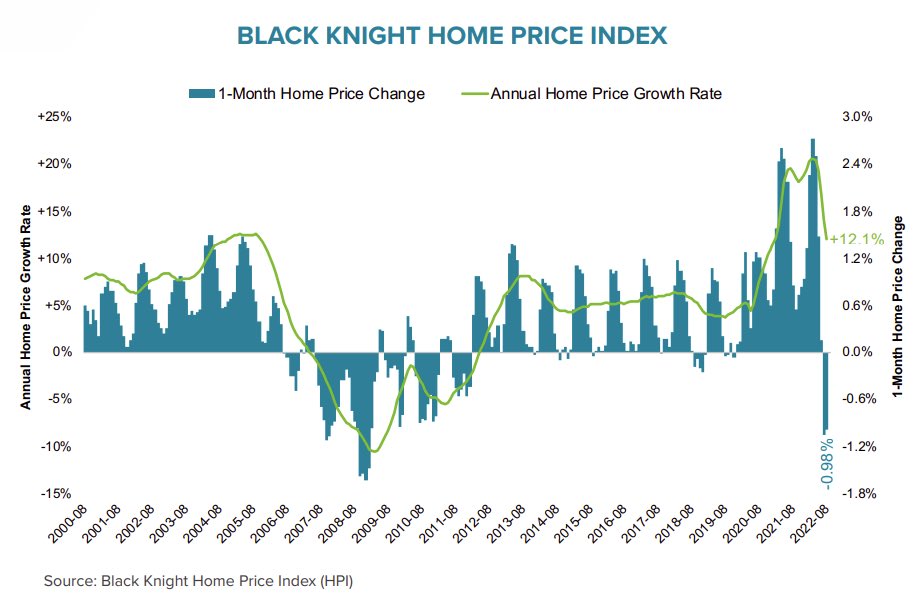

We’re in the midst of stagflation with a recession looming and the Fed has been unrelenting in raising interest rates.

Big Problems are Ahead for Real Estate Investors.

If you locked in a 30-year fixed mortgage rate on a $600,000 house at 2.6% interest rate in 2021 you have the same monthly mortgage payment as someone that just bought a $380,000 home at today’s 6.5% mortgage rate.

That’s ~37% reduction in home value based on monthly mortgage payment affordability, but that’s not the only problem lurking in the real estate market…

Bonds are back baby!

US Treasury rates are now trading at 3.97% (6-month), 4.27% (2-year), and 3.83% (10-year).

US Treasury’s now generate nearly that same yield as buying and renting out a house in America (aka the cap rate).

Would you rather tie up capital in a home, take on the costs of ownership and deal with some asshole tenant you’re renting it out to… OR simply buy US Treasuries for the same return?

Exactly.

This is going to translate to a massive real estate selloff, especially among the big wall street firms (like Blackstone) who have been buying up single family homes hand over fist.

In markets like Dallas, Austin, Denver, Salt Lake City, Seattle, and Los Angeles US Treasury rates are already higher than average cap rates.

Meaning there is very little incentive for investors to be invested in these markets. Especially if prices are going down.

Before 2010 institutional landlords essentially didn’t exist in the single-family-rental market. Now there are more than 30 multi-billion dollar institutional investment funds, such as Blackstone, focused on buying single family housing.

Next will be margin calls as banks order investors to sell off properties to deleverage their portfolio.

Many wall street real estate investors have funded their strategy using floating rate credit facilities. So every time the Fed hikes rates, their cost of capital on their EXISTING portfolio gets more expensive.

Think of the crisis in adjustable rate mortgages from 2008, but this time instead of individual borrowers getting hit with higher rates and defaulting, it’s now big landlords who own thousands of units. Sometimes all in one city or neighborhood.

The “experiment” of Wall Street buying single-family homes was never meant to last. Wall Street piled in, earned their fees, and are now looking to exit as quickly (and quietly) as possible before the crash gets bad.

Thinking about buying a new home? Maybe give it a few minutes…

Real Assets.

As the financialized world sits precariously on the edge of ruin, we must remember where there is value: commodities.

If you are a Ri Member, you understand the commodity trade, but sometimes it’s hard to remember why we are commodity investors when our portfolio is getting whacked.

This is a volatile game that isn’t for everybody, but for those willing to weather the storm and play the game to the final whistle, there can (and should!) be big rewards.

Right now the world is in a transitional period – realizing that the past 10-years of making big returns by investing in high growth overpriced tech names has come to an end.

We’re now in a world in turmoil, short on commodity supply, and on the edge of a recession. As hard as it is to stomach, this is what a financial regime change looks like – hard times and volatile markets.

We must not forget that on the other side of this trade there will eventually be institutional capital flows into commodities that will drive commodity valuations (multiples) higher.

This move will happen faster than anyone anticipates, leaving investors little time to reposition their portfolios, which is why it is essential to allocate capital while there is blood in the streets and deals are cheap.

Jamie Keech

CIO; Editor

Nick D'Onofrio

Head of Research