Friendly Fire

Have you ever wondered why we no longer invade middle eastern countries?

I’ll give you a hint. It has nothing to do with Trump, Obama, or Biden spontaneously growing a conscience.

It has nothing to do with a love for the troops.

There is one simple reason: ENERGY SECURITY

We don’t invade middle eastern countries because we don’t have to. The US shale revolution accomplished what pouring trillions of dollars and thousands of life into desert countries never could. It turned the USA into a net exporter of energy from a net importer.

The ability to economically recover shale gas is perhaps one of greatest technological achievements of this generation and, although few know it, initiated the biggest shift in geopolitics of the last 30-years. Allowing US isolationism to thrive and giving Presidents the ability to turn the other cheek when their line in the sand is crossed.

Because here is the reality: If your country does not have energy security it’s not really your country… You’re merely renting it from someone else.

Just ask our friends in the EU…

Despite ample warnings from Trump and others they’ve managed to snatch defeat from the jaws of victory and leave an entire continent exposed to the imperial ambitions of a lunatic despot.

But Jamie, that’s not fair you say? Europe can’t contend with North America’s vast geological resources. Just the luck of the draw!

Wrong!

Even though they don’t want you to know it, there is vast shale potential in Europe too. According to a 2011 study, Europe has 18 trillion cubic meters (tcm) of natural gas.

Europe has a long history of oil and gas production dating back to the mid 19th century, just like the US. The Polish Bobrka field was discovered in 1853, gas in Britain’s Weald Basin was discovered in 1875, and deep gas was discovered in Italy’s Po Valley in 1945.

There is oil and gas in Europe.

But to put this fact into context first we must explore how shale revolutionized O&G estimates for US recoverable reserves.

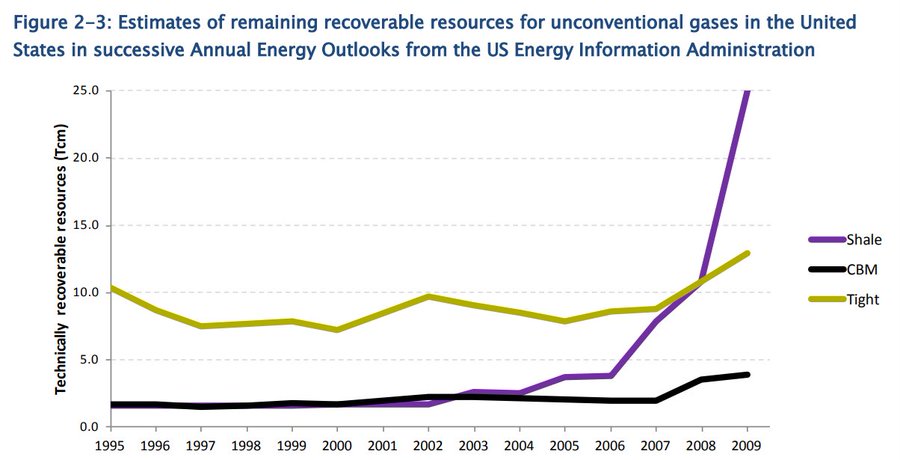

In the image below you’ll notice two things:

- Shale extraction exploded the US’s recoverable natural gas reserves

- When exploration starts reserves consistently increase (i.e. there is no short term lack of supply, only investment)

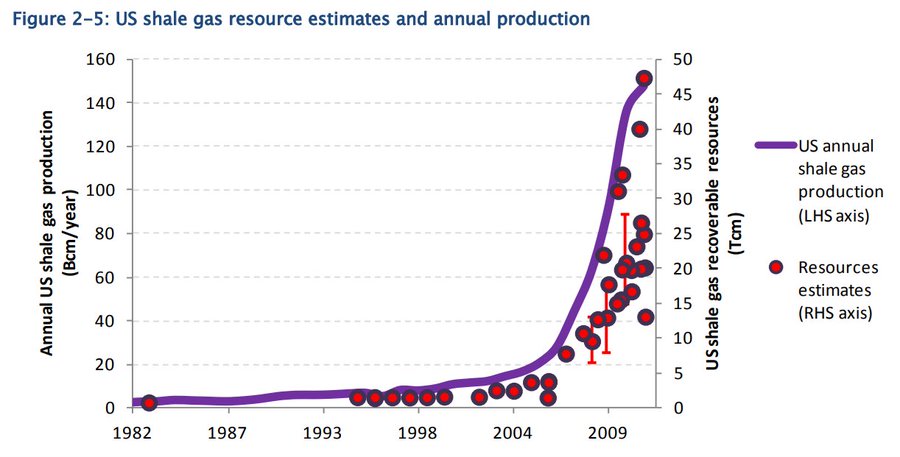

This next chart demonstrates more of the same. Basically if you invest in exploration and production (E&P) you tend to find new reserves (shocker!).

Now, let’s look at a few European countries with shale potential – which have all been thwarted by bad policy.

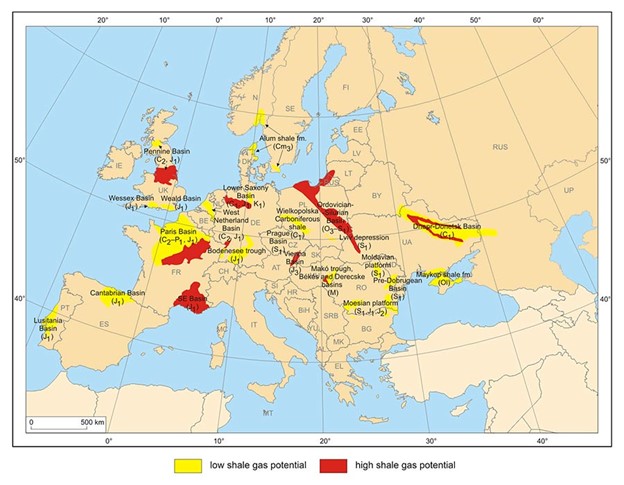

Below is a map showing several of the shale gas basins in Europe. It should also be noted that historically when large scale exploration programs have been launched they have found more hydrocarbons than expected.

European Shale Basins

Some of the most prospective shale gas fields are:

Poland: Estimated reserves of 5.3 tcm of shale gas with +1bcf/d of production possible by 2025 (~3% of the EU’s current gas demand) if development started today.

But, because of a lack of support from the EU and local governments there has not been any natural gas production to date

UK: There are shale plays in the East and South along with remaining conventional reserves in the North Sea. There are estimates of more than 25 tcf of recoverable natural gas in Britain.

No commercial gas has been produced to date – British regulations stopped shale gas exploration in its tracks via a 2019 moratorium. Today, the tide is turning. Just a few days ago, new British Prime Minister Liz Truss removed the ban on fracking.

France: The infamous Paris Basin (discovered in 1923) has produced significant oil – 800 wells have been drilled producing more than 240 million barrels of oil. The Paris Basin is estimated to have more than 5.6 tcf of natural gas resource and 558 million barrels of oil.

In 2017, led by French President Macron, parliament passed laws to become the first country in the world banning any new oil exploration licenses with immediate effect and all oil and gas extraction by 2040.

Even in the midst of an energy crisis, the French are sticking by their green policies.

The takeaway: the EU has hydrocarbon resources.

Energy independence?

There is a case to be made that within 3 years the EU could be approaching energy independence if they simply opened up the market to meaningful exploration; not just shale but offshore as well.

In the US, we saw ~30% natural gas production growth in 2 years from 2017 to 2019.

With the EU’s current high gas prices, the tailwind behind E&P growth could be much greater than what we saw in the US.

We haven’t even talked about the Dutch Groningen gas field yet – one of the 10 largest gas fields globally. Just 5 years ago the field was producing 30bcm annually. Since then, the Dutch government has reduced production to sub 5bcm annually, but believes production could easily be ramped up to 25-30bcm (16% of Russian imports).

Why did they reduce production? Because regulators believe that natural gas production out of certain regions of the Groningen gas field carry significant earthquake risk.

Europe’s reliance on Russian gas is not geological destiny, but rather choice. A choice that continues to look increasingly dire as we approach winter.

What do you think politicians’ appetite for O&G production will be after a winter of sleeping in their mittens?

Jamie Keech

CIO; Editor

Nick D'Onofrio

Head of Research