Fragile – Handle with Care

At Resource Insider we have been talking about how gold is an antifragile investment (as volatility and uncertainty increase gold strengthens), and why the current situation in the global economy has been setting up for gold to outperform broader equity markets.

Today, the economy appears increasingly more fragile as the hours pass. Let’s discuss some of the pain points that are starting to show.

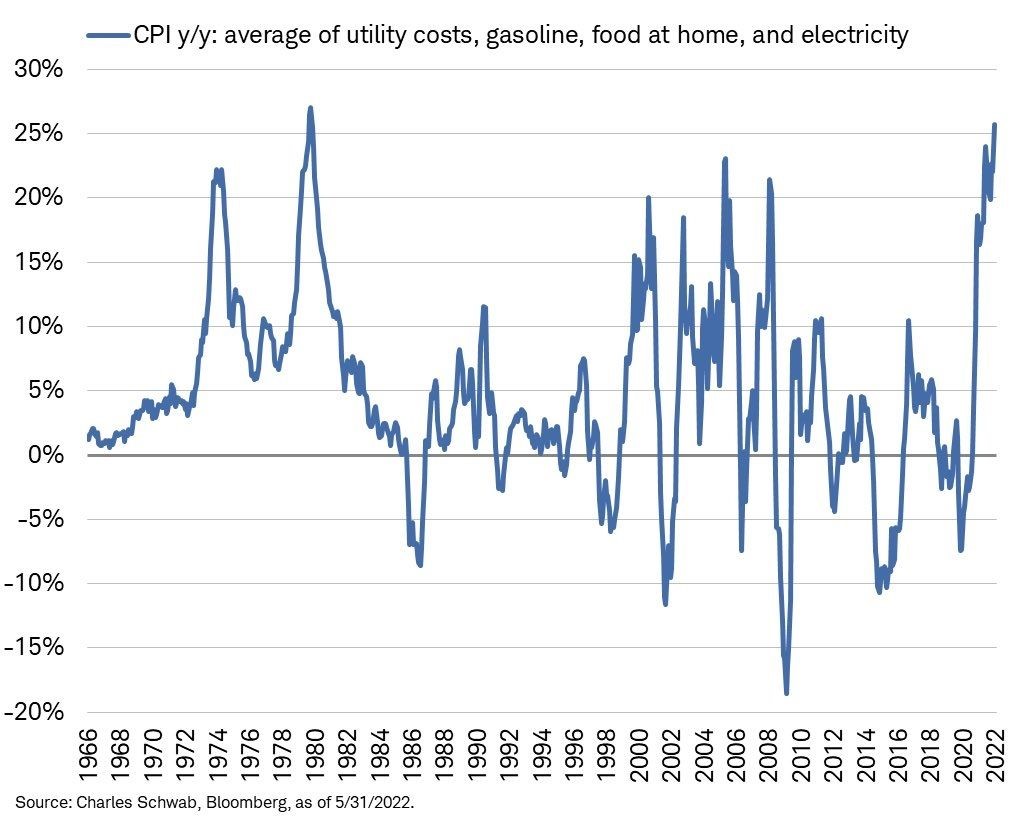

Inflation has been eating into consumer buying power as the average person’s fixed costs are skyrocketing. In May, the average cost of utilities, gasoline, food at home, and electricity printed the highest inflation number since the 1980 peak of 25.7%.

You’ll recall last year economists and politicos called inflation “transitory” declaring that consumers are “flush with cash”.

Both statements are proving to be false.

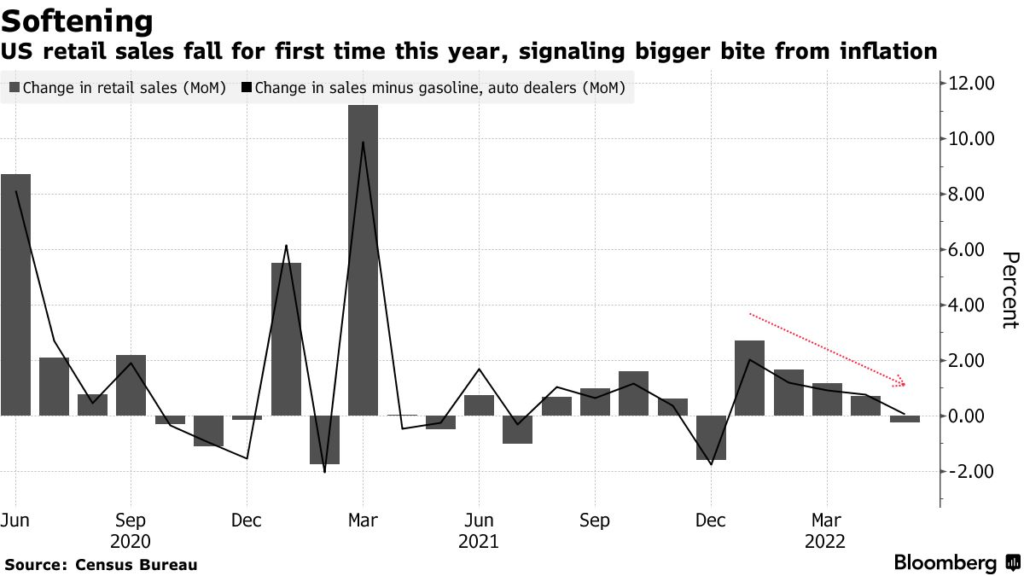

In May, US retail sales posted the first drop in five months, led by a plunge in auto sales and other big-ticket items.

Retailers such as Walmart, Gap, and others are starting to feel the pain as well. According to Bloomberg, companies that released earnings over the past 2 weeks within the S&P consumer indexes with a market cap of at least $1 billion reported that inventories rose $44.8 billion (AKA they have a bunch of stuff they can’t sell). That’s a 26% increase from this time last year.

In the past, the primary culprit behind inflation was wages. Labor is a huge component of input costs, so the Fed’s playbook to fight inflation has been to raise interest rates and increase unemployment. In the wake of globalization, the US has sustained much lower levels of unemployment without experiencing inflation.

Today’s inflationary environment is different. This wave of inflation has been driven by supply constraints, resulting in real wages going down (consumers have less purchasing power).

The Fed is fighting it by raising interest rates. In return, this is further putting a squeeze on corporate profits as the economy weakens. We are starting to see the first wave of layoffs as companies such as Netflix, Peloton, MasterClass, Coinbase, Robinhood, and Carvana have all laid off as much as 20% of their workforce. Even Tesla has announced layoffs to “keep from going bankrupt.”

Now, the cracks are starting to show in real estate.

Twin Deficits

The US is in a twin deficit, meaning there is both a current account deficit and a fiscal deficit.

- A fiscal deficit is when government spending is more than (tax) revenue.

- A current account deficit is when the value of the goods and services imported is more than the value of the products exported.

The way that a country typically reduces a fiscal deficit is by running at surplus (aka exporting more than it is importing). The US is far from running at a surplus and the fiscal deficit is in bad shape with debt levels running at 125% of GDP.

So, the only real solution to solving the debt problem is by inflating the debt away.

Meaning, making money so worthless that the debt becomes worthless as well.

Let that sink in for a minute…

When you think about from this perspective, you start to understand the high degree of inflation that could become the new norm.

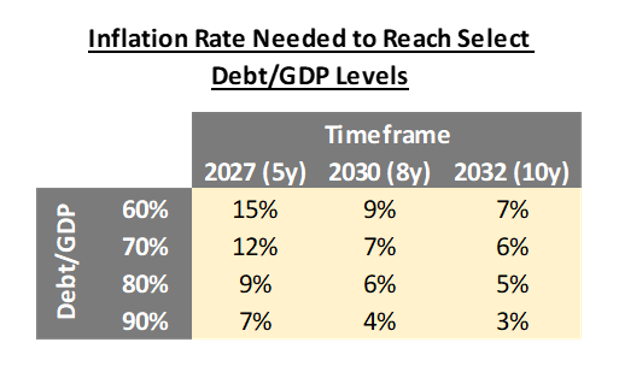

The table above shows the inflation rate needed to reach healthy debt to GDP levels assuming spending stays constant and real GDP growth is 0%.

Death to Bonds

If I were to write a guide on how to crash the US Treasury market, it would be a simple four part process.

- Stop the Fed’s QE program, which was financing the US deficits

- Raise Interest Rates, making investing expensive which slows growth

- Impede trade of the world’s biggest commodity exporter (Russia)

- Impede trade of the world’s factory (China)

Sound familiar?

That’s because ALL of these things are currently taking place.

Steps 1 and 2 are slowing economic growth and steps 3 and 4 are creating systemic inflation that the Fed can do very little to stop. All while real incomes are being cut as rising interest rates slash consumer spending.

The result?

Death to bonds.

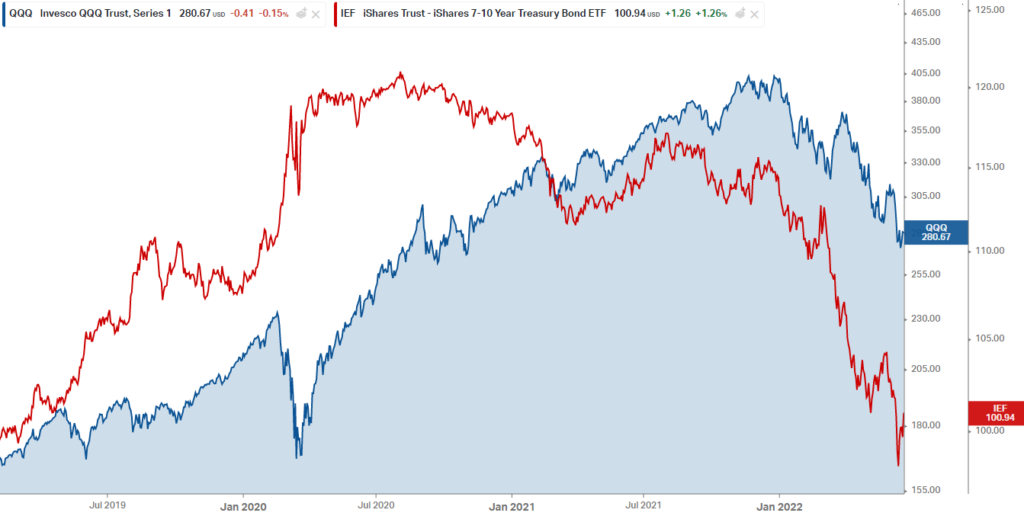

Since the pandemic started, US Treasuries have been highly correlated to equity markets, which you can see in the chart below. The NASDAQ is in blue and US Treasuries in red.

If the bond market is dead, where will people find solace?

I think that answer HAS to be GOLD. (especially considering the recent implosion of bitcoin)

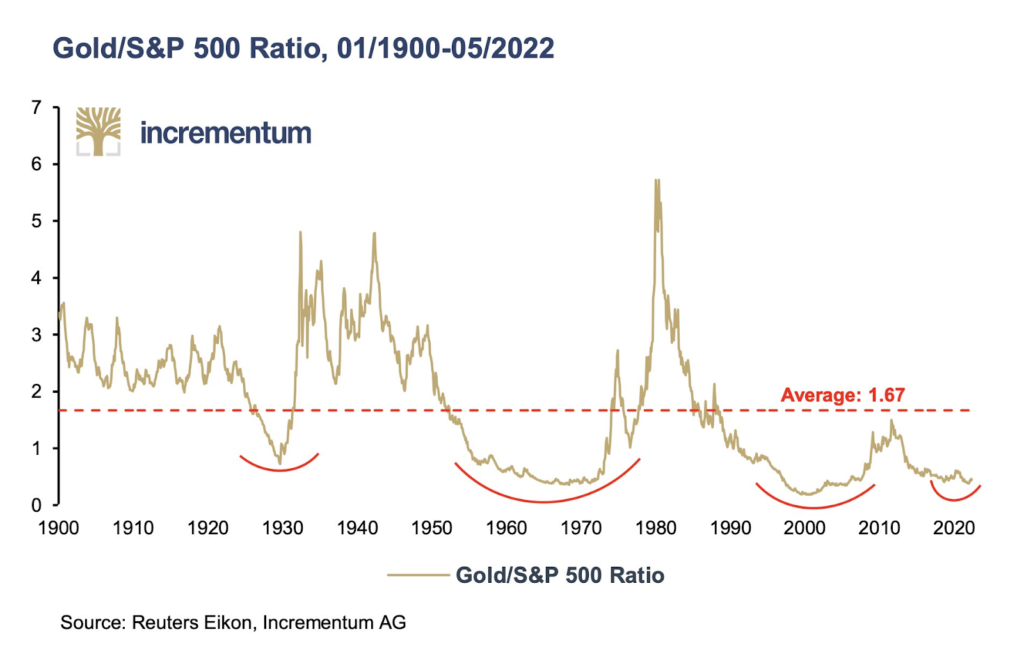

According to Incrementum, gold could more than triple against the S&P 500 if it reaches its 122-year median of 1.67 over the next ten years as the ratio is at 0.47 today.

One last thought to keep in mind.

Gold will likely not take off until the general investor loses faith in bonds, stocks, and the general economy. This is a long process, and we are still likely +8 months away from that becoming a reality, but when the move happens it will be fast and violent.

Prepare accordingly my friends.

Jamie Keech

CIO; Editor

Nick D'Onofrio

Head of Research