Is the World Short Oil & Gas

Energy markets are the talk of the town right now, and for good reason.

Here are some headlines:

- Nord Stream 1 and 2 are down

- US petroleum stocks are below the 5yr range

- OPEC+ cuts production by 2million bbl/d

Nord Stream

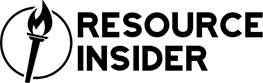

The Nord Stream pipelines connect Russia to Germany via the Baltic Sea. Nord Stream 1 historically supplied the EU with ~35% of the total gas imported from Russia; Nord Stream 2 (which was on track to be operational in the first half of 2022) is equally as large.

Both Nord Stream 1 and 2 are down after suffering catastrophic losses of pressure. No one is exactly sure what happened to the pipelines, but the Swedish Security Service said that they found evidence of detonations and have high suspicions of “gross sabotage.”

No matter who attacked the pipelines, the results are clear: Europe is in for a very tough winter.

It’s estimated that it will take at least 20-25 weeks just to get all of the materials and equipment in place to repair the pipelines. Meaning that there is no way to repair the pipelines for at least 6 months… Probably much longer.

This leaves Europe very short on energy heat homes this winter. Protesters are claiming they will be forced to choose between eating or heating their homes.

The damage to the pipelines means that Russia just lost substantial physical capacity to transport natural gas to Europe, even if current sanctions are removed. With the loss of the pipelines, also comes the loss of any leverage for Europe to bring Russia to a compromise over the Ukraine invasion… Which just made this war much more complicated.

We should all be paying close attention to the pipelines connecting Russia to Europe via Ukraine. These pipelines just became essential to the EU.

If Ukraine was looking for leverage to join the EU and/or Nato… They just got it.

US Petroleum Stocks

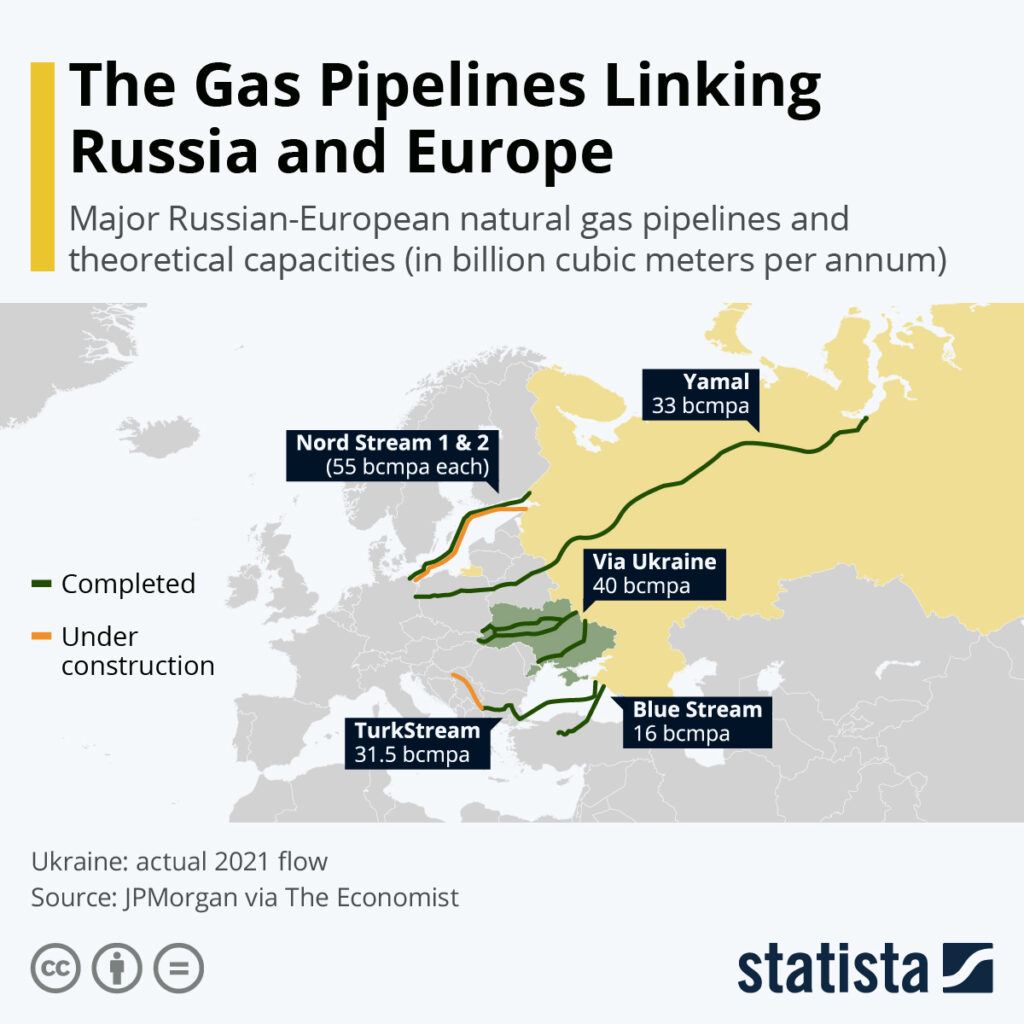

The US’s Energy Information Administration (EIA) releases a weekly inventory report – this week’s was quite telling.

Two noteworthy items:

- Gasoline demand increased

- Total petroleum stocks fell below the 5-year low once again

In short, demand is strong and supply is struggling to keep up in a big way. Petroleum stocks haven’t been this low since 2004.

What made this particularly important is that a few hours later it was announced that…

OPEC+ Cuts Production

OPEC+ is a group of 23 oil-exporting countries that decide how much crude oil to sell on the global market.

At the core of this group are the 13 original members of OPEC (the Organization of Oil Exporting Countries), which consist of mostly Middle Eastern and African countries. OPEC was formed in 1960 as a cartel, with the aim of fixing the worldwide supply of oil and its price.

Today, OPEC+ nations produce around 40% of the world’s crude oil; the two biggest producers being Saudi Arabia and Russia.

Just a few weeks ago it was reported that Russian President Vladimir Putin met with Saudi Crown Prince Mohammed bin Salman (MBS) suggesting that OPEC+ cut production.

Those suggestions became a reality as OPEC+ agreed to cut production by 2 million barrels per day.

Given the fact that OPEC+ has struggled to meet their production quotas, this cut will more likely look like a cut of ~900,000 barrels per day to the current supply.

Most of that production cut will come from nations that have a complicated history with the west: Saudi Arabia (48%), UAE (16%), Kuwait (15%), and Iraq (11%).

What drove the production cuts?

The United Arab Emirates’ (UAE) energy minister, Suhail Al Mazrouei, said that the group was solely focused on avoiding an oil price crash similar to 2008.

Mazrouei said “In Europe they have their story, in Russia they have their own story. We can’t be siding with this country or that country.”

With a recession looming OPEC+ is most concerned about keeping a finger on the pulse of global oil supply and demand to maintain profitable prices.

The takeaway?

Oil and gas prices will likely head lower in the short term if the world heads into a recession, but they won’t be staying low for long. OPEC+ is determined to keep prices high even in the midst of a recessionary environment.

Remember, recessions massively impact oil and gas markets. Inventories rise when, and only when, the business cycle slows; this in turn leads to lower production capacity.

The world is short on energy supply and any reduction in production capacity will have a longstanding impact on the market. This will only be righted through significant investment in new production.

Unfortunately, the US is working hard to beat the EU in the global “idiodic energy policy competition”.

Here’s a short summary of some of the current administration’s noteworthy policy decisions:

- Kill Keystone XL pipeline on Day 1

- Drain the Strategic Petroleum Reserves (SPR) before midterm elections

- Tell oil and gas producers to lower prices at the pump…. Seriously WTF?!?!

- Beg Saudi Arabia and Russia to produce more oil

- Contemplate banning exports on refined products and gas

- Lift Venezuelan sanctions to import more oil

If you’re not long oil, you might want to reconsider…

Jamie Keech

CIO; Editor

Nick D'Onofrio

Head of Research