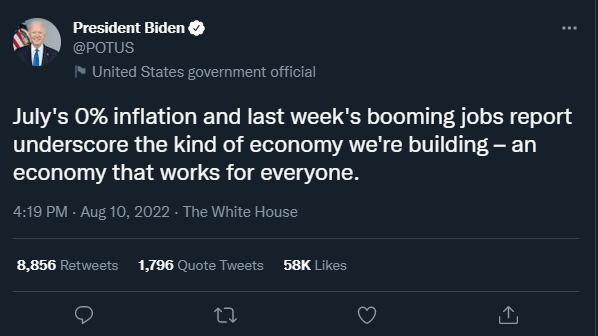

Democrats passed the Inflation Reduction Act and it magically made inflation vanish, even before the bill was signed into law. This is how good the bill is, it retroactively reduced inflation.

No, this is not Biden having a brain fart. This is the official messaging of the current administration.

Now, this isn’t exactly a lie – the official inflation number increased 0% from June to July (month over month), but it did increased by 8.5% year over year.

The Market Responds

Inflation fell from 9.1% in June to 8.5% in July, and the market believes that the Fed is getting closer to hitting a homerun (AKA gradually cooling inflation without a recession). This bodes well for stocks and the USD, and the market is reacting accordingly.

As we mentioned a few weeks ago, the US looks like a much more attractive home for capital at the moment than the rest of the world. For this reason, we’ve been predicting this rally in equity markets… But I wouldn’t get your hopes up as we don’t expect it to be long lived.

Industrial output peaked in 2Q 2022. What many investors got wrong was the assumption that following this peak would be an immediate recession. Before we see a recession, manufacturing jobs have to start contracting. In July, manufacturing jobs increased by 30,000.

The 30,000 jobs created are half of what that number was in April, which establishes a slowdown, but not a contraction.

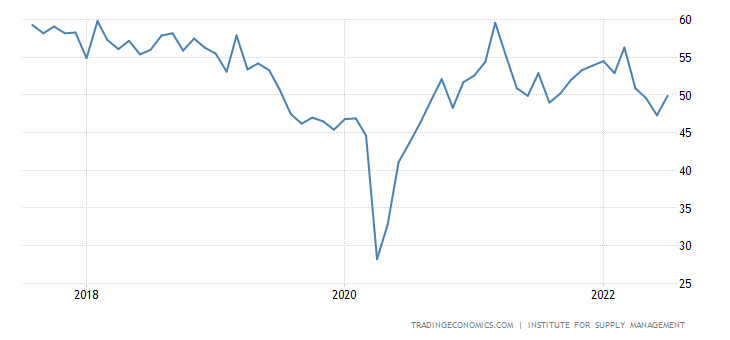

Manufacturing jobs are a lagging indicator, but tend to be led by the ISM Manufacturing Employment Index by about 3 months. This is also yet to decline in a manner that would indicate we are in a recession.

ISM Manufacturing Employment Index

So, over the past 2 weeks the market has apparently decided that we’re not in a recession, the economy is strong, and inflation is declining…

All this misses a few key points.

If inflation stays at 0% month over month for the remainder of the year, December’s inflation number will still land at 6.3% year over year. Which is still 3x higher than the Fed’s target of 2%.

Meaning, the Fed isn’t going to pivot – they’ll likely be hiking rates into 2023.

Here are the major events leading up the September Fed meeting and the importance of each event:

- Fed’s Jackson Hole Economic Symposium: end August (updated Fed guidance)

- Monthly Jobs Report: Sept. 2 (indicator of economic growth)

- September Inflation: Sept. 13 (will determine magnitude of rate hikes)

- Fed Interest Rate Decision: Sept. 21

The road to this imagined September pivot on rate hikes will be paved with pain as investors come to realize that the economy is neither in a growth or recessionary phase. We are in the midst of STAGFLATION – stagnant economic growth paired with high inflation.

Let me be as clear as possible.

Inflation will not resolve itself, the Fed will have to slow the economy to contain inflation. The market will likely come to this realization when 2023 corporate earnings expectations are slashed.

Meaning, eventually the economy will roll over into a recession and only then will the Fed pivot on interest rate policy.

Tech jobs are getting slashed left and right. Many of my tech friends are telling me their companies are in the midst of laying off 30% of their workforce.

Housing is beginning to cool off as well – new homes for sale are handily outpacing new homes sold. In the last 50 years, this has always led to a recession, and usually an ugly one, as housing stats and GDP tend to be very closely correlated.

New Homes for Sale (Orange) vs. New Homes Sold (White)

The size of the gap between Housing Sales and Houses For Sale suggests a recession like 1974, which was pretty damn ugly.

Which are you going to be?

The world has yet to come to

terms with the fact that we are not going back to an environment supported by

low inflation, globalization, and cheap energy.

Out

of control government spending continues to tip the debt/GDP scale in the wrong

direction, which is wildly bullish for precious metals.

Meanwhile,

destructive environmental and energy policies continue to drive capital out of

the commodity sector and reduce supply. This has been the first commodity

upcycle to end without any significant capex being spent.

Think

about that, prices of commodities went up, and almost no money was spent

increasing supply… thus offering no price relief.

Once we get through

this bumpy patch, what is it going to take to actually bring more supply

online? Commodities such as copper, oil, gas, uranium, lithium, etc will NEED

to be much much more expensive.

Jamie Keech

CIO; Editor

Nick D'Onofrio

Head of Research