Rates & the Market

Recently we discussed how, as the Fed raises rates, we expect the dollar to continue its move higher, and a subsequent rally in broader equity markets.

We are currently seeing this trade in full swing as the Fed raised the fed funds rate last week by 0.75% to 2.25% and the S&P 500 is trading at about 4,125 (up from 3,700 a few weeks ago!). Stocks are still following the playbook from the past decade, acting as though the Fed will soon ease interest rate policy.

This rally will be short lived.

Things are different in a post pandemic world – inflation, not deflation, is now public enemy number 1. Under the current economic conditions, the Fed will likely continue hiking rates into the fall until inflation is under control.

The only way inflation is going to slow is through a true recession, the kind where we see mass layoffs and real economic hardship. Only then will the Fed finally start slowing hikes or cutting rates.

This recession is coming faster than most believe.

It’s going to be painful BUT it will kick off the next bull market in precious metals. In the meantime, it is important to understand why markets are behaving the way they are.

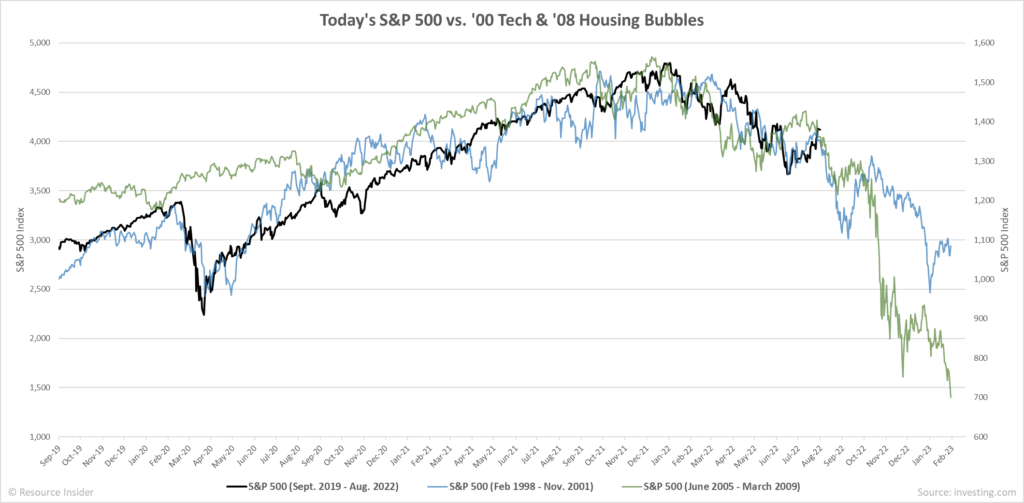

The chart above compares the S&P 500 today (black) with the S&P 500 during the 2000 tech bubble (blue) and the 2008 housing bubble (green).

As you can see… It’s not looking good for our generalist friends.

Gas & Fertilizers

The green revolution tribe is quickly turning into a death cult. The hardcore greenies are pushing forward policies that are going to have very scary impacts on access to food and energy.

Prime Minister Justin Trudeau is pursuing the same climate policy that sparked mass protests in Europe.

The Trudeau government introduced a plan to reduce nitrogen emissions from fertilizer use similar to the Netherlands policy that sparked protests among thousands of farmers.

The plan to achieve emission targets set by the Canadian Federal government calls for reduction in fertilizer production by 30%.

Now… I’m no farmer, but I have been blessed by a bit of common sense, and it’s telling me:

Less fertilizer = Less food

Let’s take a look at our friends in Sri Lanka who decided to ban organic fertilizers which cut crop yields in half.

Turns out hungry citizens don’t

make the best constituents… Conversely they do appear to have more energy to

occupy Presidential Palaces.

While

we’re on the topic of fertilizers…

Last

Wednesday, Germany’s BASF (the world’s largest chemical company) cut ammonia

production even further to preserve natural gas for electricity use. Germany’s

first and fourth largest ammonia producers, SKW Piesteritz and Ineos also said

they could not rule out production cuts as the country grapples with disruption

to Russian gas supplies.

It’s

looking like a long, cold and now hungry winter for Europe.

Famines & Fertilizers.

Farmers

rely on three key nutrients for fertilizer: nitrogen, phosphorus, and

potassium. A combination of these elements is used to fertilize crops and

maximize harvests. Natural gas, after being converted to ammonia, is the main

feedstock for nitrogen based fertilizer.

Most of

the world’s ammonia is used for making nitrogen fertilizers.

Fertilizer

shortages not only mean that prices have been rising, but many farmers are not

even able to buy as much fertilizer as they need. This has led to farmers all

over the world struggling to figure out how to keep crop yields up with as little

fertilizer as possible.

This

might sound like a distant problem, but less fertilizer is going to lead to

food shortages. The world’s biggest soybean producer estimates that a 20% cut

in potash (potassium) would result in a 14% drop in yields. The International

Fertilizer Development Center is predicting that this year’s rice and corn

harvest in West Africa will shrink by 30%.

Food

shortages make food more expensive. Even in the best-case scenario, experts are

calling for lower crop yields and higher grocery store prices across the board

on everything from milk to beef to packaged foods. This could last for months

or even years.

Food

inflation causes people to eat more processed/unhealthy food and poor diet

leads to a litany of health consequences.

Energy

supply is life.

The takeaways.

There

are a few important points to note:

- We have not fully experienced the effects of the Russian invasion

– markets are trying to price in expectations, but we haven’t seen

supply/demand shortfalls fully play out yet.

- The energy and fertilizer shortage is going to sustain

inflationary pressures.

- The same inflationary pressures are likely to stir more and more

civil unrest around the world.

This wild ride is just getting

started. Stay vigilant and diligent, there will be opportunities to make a few

fortunes over the coming years for those paying attention.

Jamie Keech

CIO; Editor

Nick D'Onofrio

Head of Research