Gold – I hate it. I have never been a gold bug. I’d rather buy metals with industrial demand, but that doesn’t mean I don’t understand the value of, or own, gold.

Today, gold makes up the largest portion of my investment portfolio.

I am buying (the right) gold stocks aggressively. To understand why, have a look at a recent tweet of mine that garnered some attention:

This tweet has nothing to do with my political affiliation, or beliefs.

I’m an investor, an observer, my job is to synthesize information and seek out opportunities that will make me (and my fellow investors) as much money as possible.

This is the process that led me to buy so much damn gold.

You see, gold is a hedge against bad government decision-making, it is antifragile.

Antifragile

Antifragile is a word and philosophy created by Nassim Nicholas Taleb that helps investors account for luck, uncertainty, probability, human error, and decision-making in a world where we don’t, and can’t, fully understand the risks we face.

There was no word for the opposite of fragile; so Taleb created “antifragile.”

Instead of getting damaged by strain, that which is antifragile grows, benefits, and becomes stronger after being exposed to stress, uncertainty, and volatility.

When antifragile systems are deprived of stresses and volatility they become weaker.

Biceps are antifragile – the more you work them the stronger they get. Skip the gym and you become a withered shell of a man.

Gold is antifragile.

It’s the oldest form of currency, and store of value, still in use today because it’s antifragile. Gold survives and thrives on incompetent politicians, natural disasters, global pandemics, and uncertainty.

The greater the unknowns, risks, and volatility, the better gold performs.

But, what does gold protect us from exactly?

It’s not direct protection against inflation or stock market crashes. Gold is protection against cracks in the economic system. More specifically, gold is a protection against poor decisions by the government.

Inflation and stock market crashes are a byproduct of these poor decisions.

The best way to hurt the price of gold is to run balanced budgets.

This means fiscal conservatism. Over the past 20 years, both Democrats and Republicans have become very fiscally liberal.

The world has been seduced into believing that we can print and spend our way to prosperity, but real wealth is created by individuals and businesses working for their own gain to benefit society as a whole.

Reality Check – what do the numbers say?

It is hard to measure antifragility, and it is even harder to measure “bad government decision making,” but after digging through the data we’ve identified two important drivers behind gold price.

Real Rates; and

The U.S. Fiscal Deficit.

Here is the two-minute overview and how you, as an investor, can use this info to make money.

The Golden Barometer – Real Rates

Real rates are interest rates adjusted for inflation.

Real Rate = Interest Rates – Inflation

When interest rates rise faster than inflation, real rates go up and gold does poorly.

When inflation outpaces interest rates, real rates fall, and gold prices run.

The dropping pressure on a weather barometer signals we’re in for a storm. Dropping real rates indicate gold is about to be hit by a money storm.

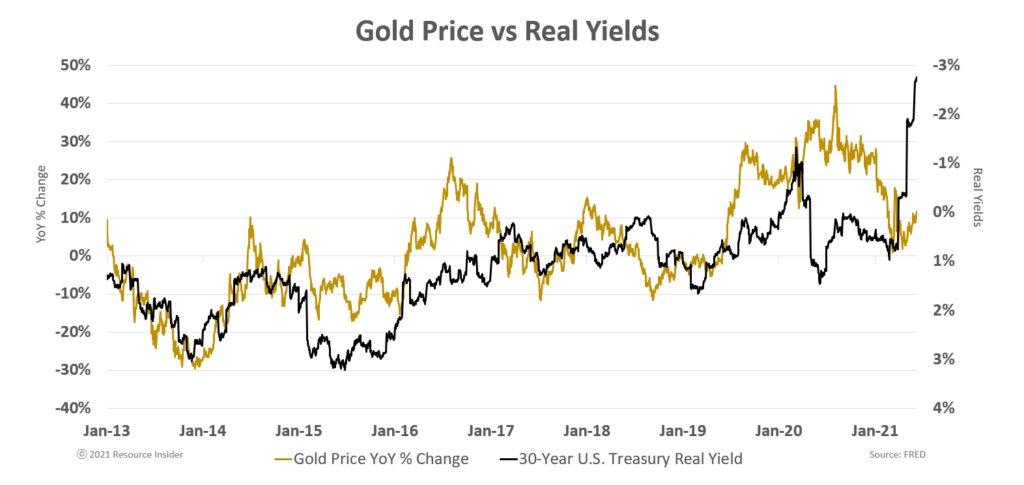

The following chart demonstrates just how closely the gold price has tracked real rates for the last 8-years.

Real yields are in black.

Yellow is annualized gold price.

The takeaway is simple, gold prices should be surging higher very soon. Based on the historical data we expect gold to move up by 20-40%.

Beast of (Fiscal) Burden

The Congressional Budget Office estimates that the 2021 deficit will be slightly less than last year’s total at $2.3 trillion.

But, this is pretty much bullsh*t as it does not include:

The $1.9 trillion (TRILLION!!!) stimulus package passed by congress; or

The proposed $1.7 trillion infrastructure package currently in the works.

So, we can take that $2.3 trillion (which took decades of fiscal mismanagement to achieve) and 2.5X it.

Let that sink in… the USA is now on track to effectively triple its deficit in a 1-bloody-year!

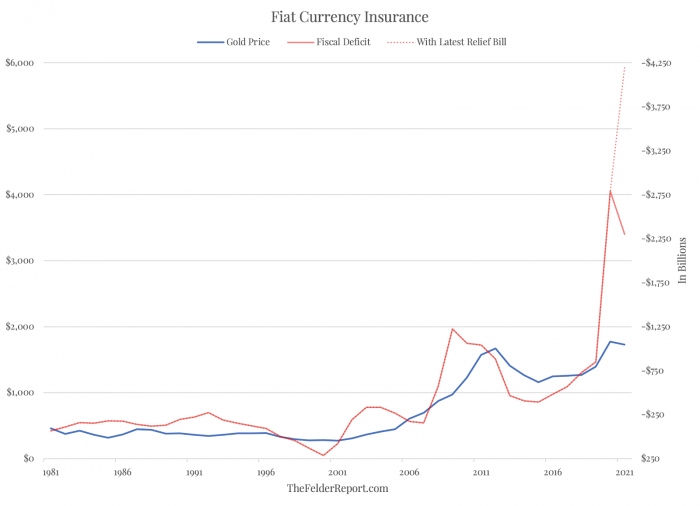

Look at this chart:

Note: The red line ONLY includes the 2020 deficit. The dotted line represents the $1.9 trillion stimulus package… the remaining ~$4 trillion deficit still has to be added on top of the dotted line!

Notice how the blue line (gold price) has yet to catch up to the rapidly increasing red line (fiscal deficit)?

Well… if the last 30 years of known data are any indication, it’s going to.

Gold hasn’t even caught up to the 2020 deficit, let alone the coming astronomical 2021 deficit.

MEANING: We believe gold price is going up. WAY UP.

How I’m Playing

100% returns are stellar, but 1,000% returns are life-changing. If you want to make 100 decent returns buy a gold ETF. If you want to make life-changing money, then you have to invest in gold miners.

After years of working for, researching, and investing in mining companies, I have found that the best returns come from investing in IPO stage deals. All day, every day, I am scouring the globe for mining deals. Every once in a while I find something special.

I have one of those opportunities on my hands right now.

The deal I’m about to invest in, Project Roadhouse, is my biggest investment this year. Project Roadhouse is a pre-IPO, gold company led by one of the most successful mine finders on the planet (a man that’s created billions of dollars in shareholder value).

I believe this deal has the ability to deliver asymmetric multi-bagger returns for my portfolio and those that invest alongside me. Not only are Resource Insider Members and I getting into this deal at prices I consider far cheaper than market value, I’m also getting warrants as part of my investment, or to put it simply – free options.

If you’d like to learn more about Project Roadhouse you’ll have to join Resource Insider where you’ll have access to the exclusive research report on this deal and detailed instructions showing you how to invest.

OR…

Learn to Invest in Private Mining Deals

I am hosting a free webinar on Thursday, August 5th, 2021, @ 1pm EST.

In this webinar, I’ll walk you through my entire investment process line by line. You’ll learn

How to finds deals;

How to evaluate projects;

How to invest in the best management team;

And how my members and I have made 2x, 5x, and 10x returns on recent investments.

When we’re done you’ll understand how to source your own deals (opportunities like Project Road House), get access to the best opportunities in the sector, and easily invest your money into these private deals.

REGISTER NOW

Spaces are limited, so reserve your spot now.

Cheers,

Jamie Keech

Founder, CIO & Editor; Resource Insider