A closer look at the markets.

I am not saying that a recession is imminent, but one may be lurking around the corner; and if it’s not a recession, it’s probably recession’s cousin stagflation.

Let’s take a quick look at what we’re seeing.

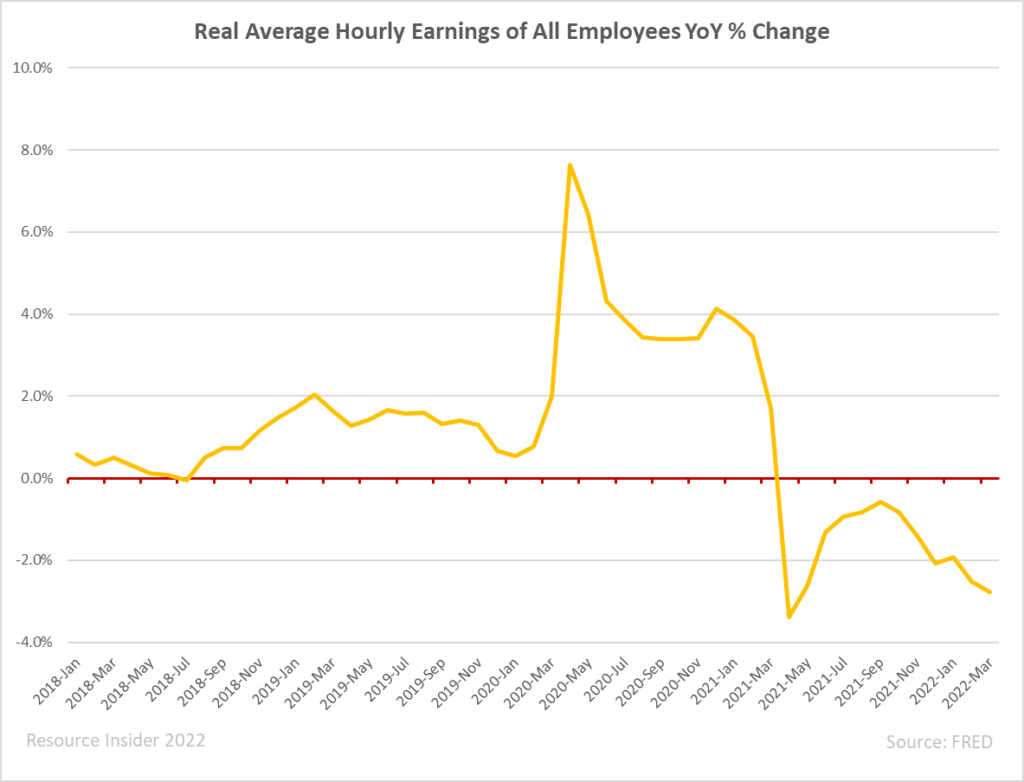

Real Wages – Wages adjusted for inflation have been growing at a negative rate since April 2021. This means that people are making less today than they were in May 2021 (in terms of buying power).

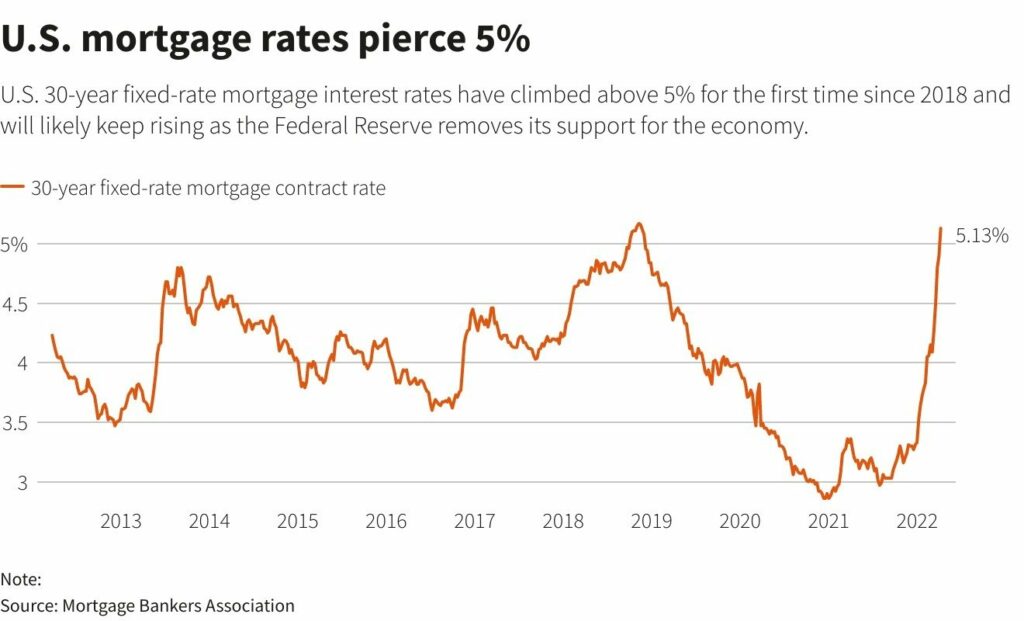

Mortgage Rates – Mortgage rates are now above 5% and are set to continue rising as the Federal Reserve has an aggressive rate schedule of rate hikes planned for 2022. This is important because the Fed is just starting its rate hike cycle.

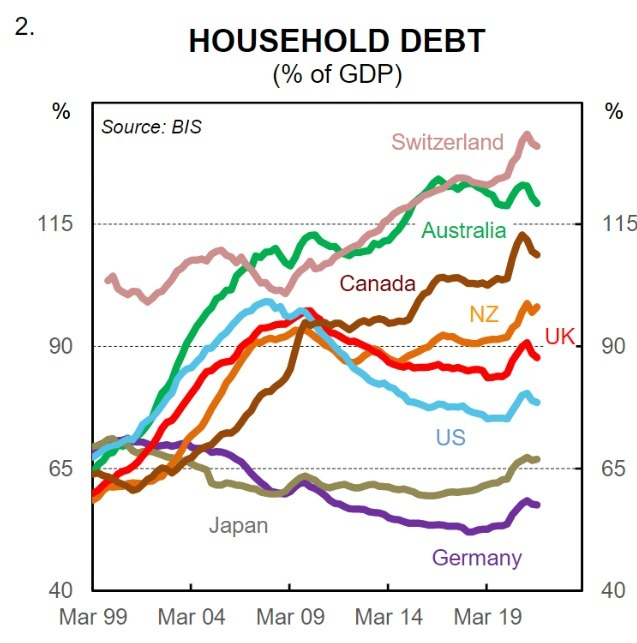

Household Debt – Total household debt is above 100% of GDP in countries such as Canada, Australia, and Switzerland (Meaning: the people owe more than the total country’s GDP). Higher Fed rates also mean higher revolving and floating debt rates for households.

Producer Price Index (PPI) – Price index that measures the changes in prices received by domestic producers. In other words, what producers of goods pay for their raw materials. Year over year % change in PPI is now the highest it has been since the early 80s.

The Chairman of Restoration Hardware said it plainly:

“I don’t think anybody really understands what’s coming from an inflation point of view, because either businesses are going to make a lot less money or they’re going to raise their prices. And I don’t think anybody really understands how high prices are going to go everywhere.”

Some people remain bullish broader equities based on the idea that we are at peak inflation. I don’t see that as a reality as long as PPI keeps surging, because we have 2 options:

- Companies eat the price increases and margins collapse

- Companies pass on the price increases to consumers, inflation keeps rising (buying power continues to erode), and the Fed plans even more rate hikes.

What is my takeaway from all of this?

The world is in a very precarious position. The pundits that said “don’t fight the Fed” are now fighting the Fed. The same people who said the consumer is strong with 1.8% inflation are saying they’re still strong at 8.5% inflation.

My point is we’re not only seeing perma-bulls we’re seeing perma-BS, and there are already warnings of a flagging market. Netflix is ~70% off its highs, wiping out 4 years of gains in a few weeks. JP Morgan shares are down ~40% after last week’s earnings showed a slide in profits.

You can see from the chart below that JPM’s stock is highly correlated to the S&P 500. Are these stocks the proverbial canary in a coal mine?

That remains to be seen.

I do not know if the market will sell off tomorrow, in 7 months, or if it’ll mostly trade sideways for the next few years.

What I do know, is that when the market turns over, it will be time to own precious metals. I am a firm believer in gold as an antifragile investment – which we have talked about at length over the past several months.

“Antifragile is a property of systems in which they increase in capability to thrive as a result of stressors, shocks, volatility, noise, mistakes, faults, attacks, or failures.” – Nassim Taleb

For gold, this means that as volatility and uncertainty increase gold strengthens.

The world is entering tumultuous times. I know many of you are disappointed in the recent performance of precious metals miners, but I expect the tides to be turning over sooner than later.

Jamie Keech

CIO; Editor

Nick D'Onofrio

Head of Research